published on The Star dated 2nd Mar 2024

Reanda Malaysia

Empowered by knowledge

Reanda Malaysia

Empowered by knowledge

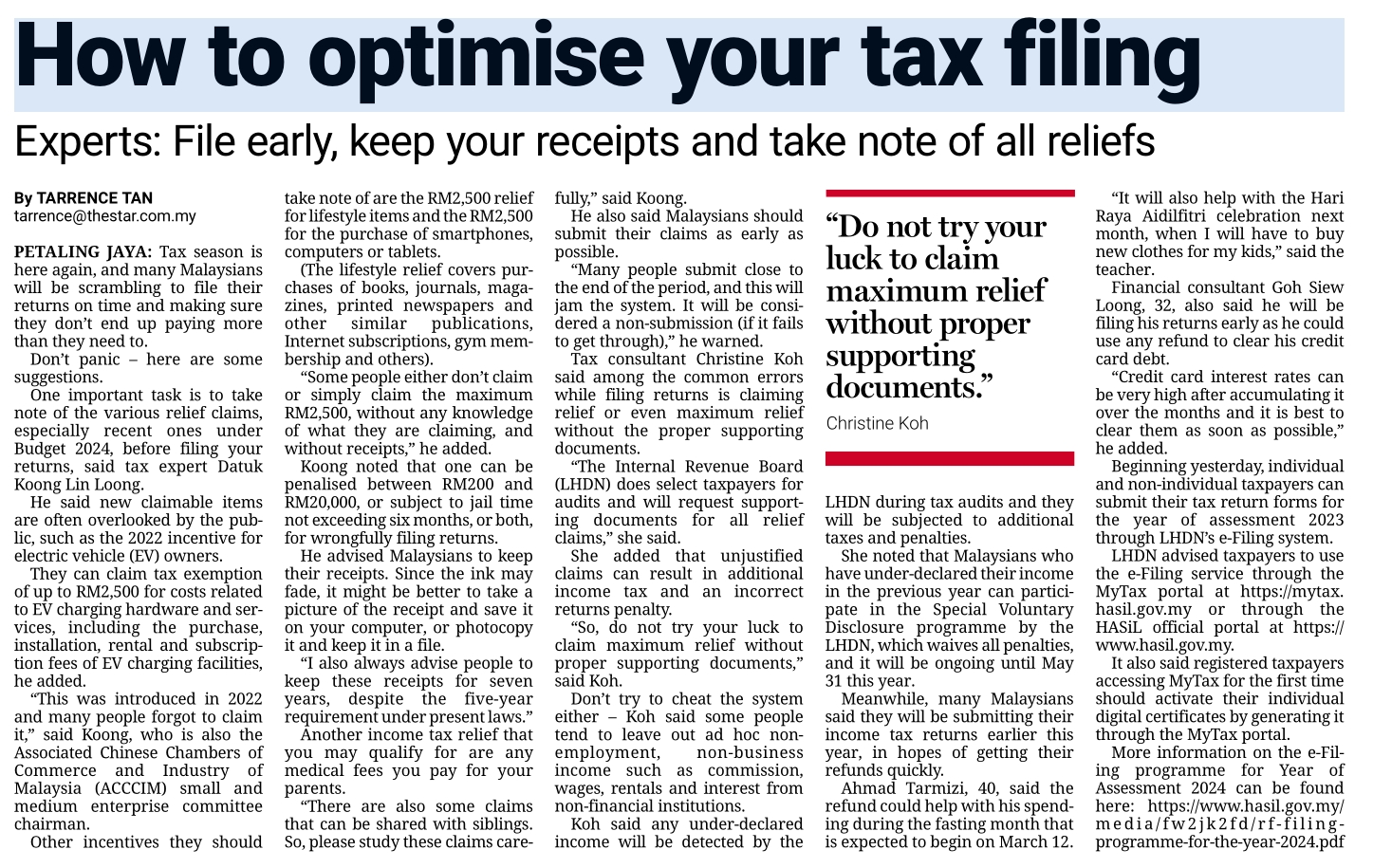

published on The Star dated 2nd Mar 2024

MALAYSIANS can expect some solace or silver lining amid the drastic fall of the ringgit as the Employees’ Provident Fund (EPF) is likely to declare 2023 dividend payout between 5.5% and 5.8% in early March.

The Star dated 28th Jan 2024

The Star dated 23rd Jan 2024

The Star dated 3rd Jan 2024

The Star dated 1st Jan 2024

Datuk LL Koong: “Both FDI and DDI are important and our government must improve the ease of doing business, which has been said often but not dealt with. Consolidating the licences and permits processes is necessary to attract FDI.”

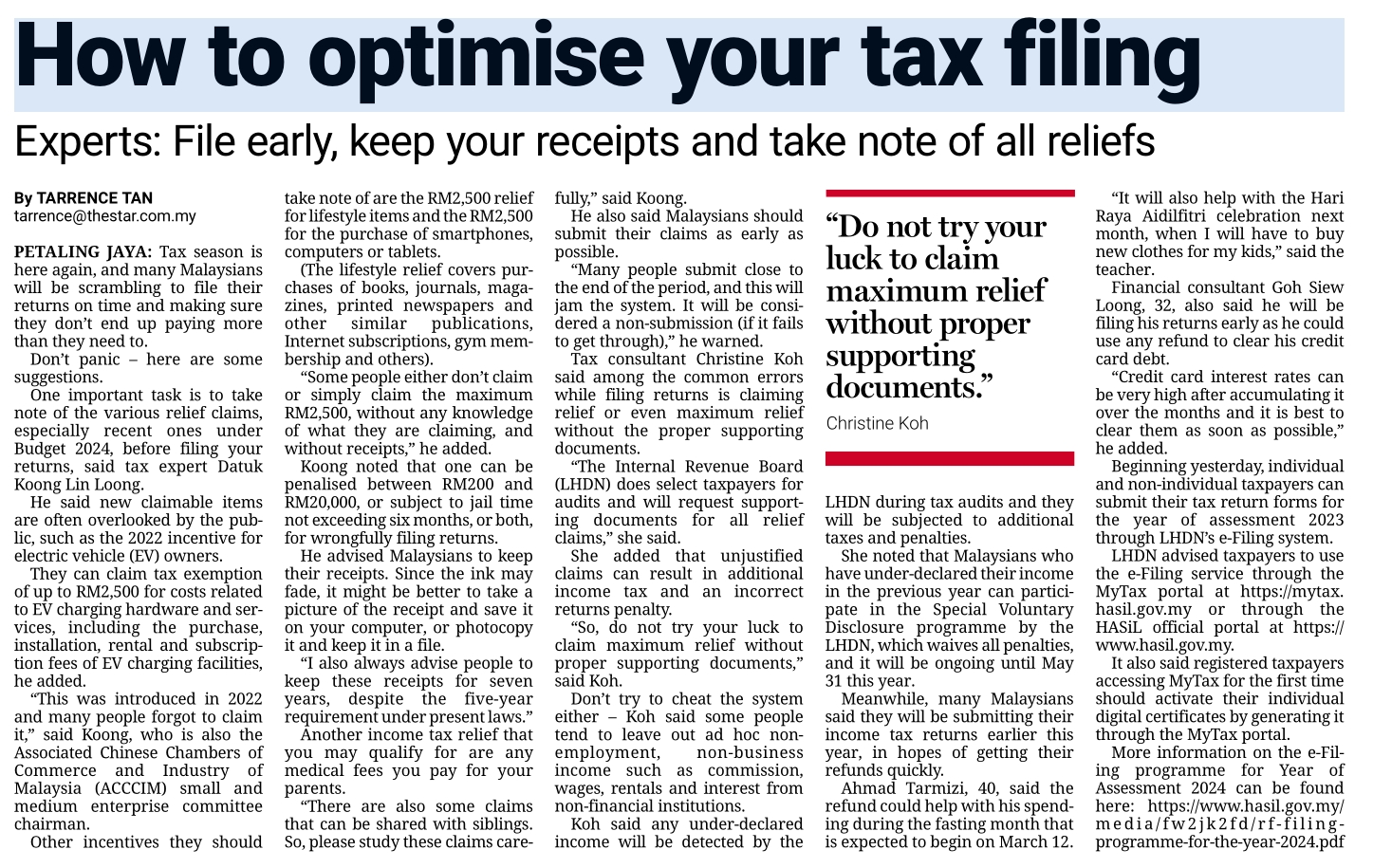

Koong: various ecommerce platforms would need to facilitate the charging of the LVG sales tax. Customs Department may want to provide more details about direct online purchases from overseas sellers who are not registered with the department.

~ The Star dated 21st Dec 2023

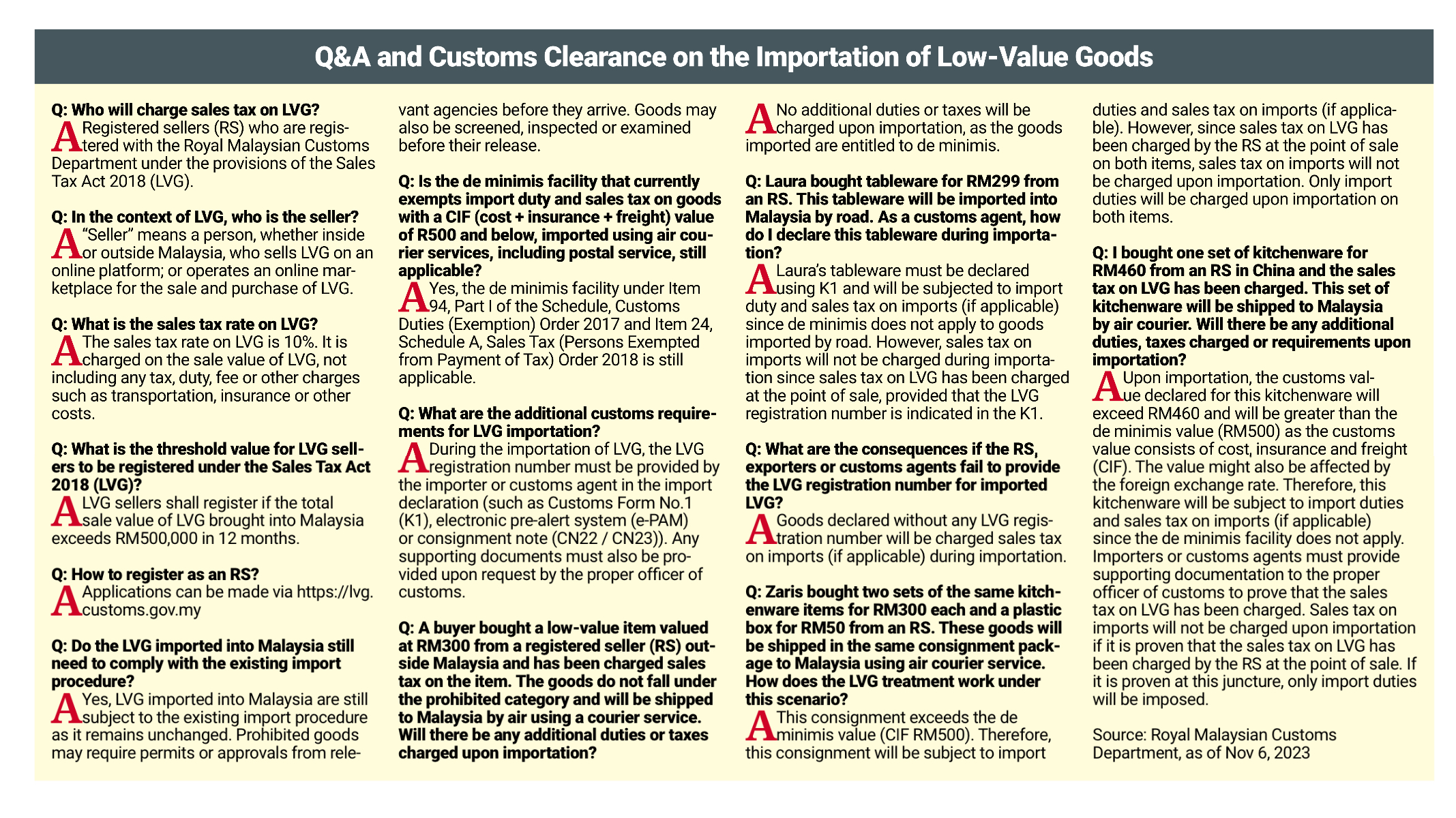

LL Koong: "For those who wanted to buy a computer or any other device and intend to claim tax relief for it in 2024, make sure you do it before the Dec 31, 2023 deadline. If you delay the purchase until January 2024, you will lose out on the claimable lifestyle relief for 2023 and only claim it in Year of Assessment 2024, which is in 2025.”

~ interviewed by The Star dated 2 Dec 2023

LL Koong: There should be more detail on the overall mechanism, which includes the sub-categories of each item that would be taxed... We need more time before we can implement the new tax. This is because there are still a lot of things that the government needs to iron out. They need to engage with the specific industries involved, not only general groups. For this, we need about 12 months before implementation... there were also no revenue projections by the government on the HVGT while there was an absence of estimated administrative costs of the implementation.

interviewed by The Star, 27th Oct 2023

Datuk Koong Lin Loong hopes that Budget 2024 would also prioritize the integration of ESG that contributes to industrial growth. "Ultimately, this will result in infrastructure and economic development that can boost Malaysia's competitiveness on a global scale in the long term".

For full report, please refer to The Star portal: https://www.thestar.com.my/news/nation/2023/09/29/budget-2024-seeking-climate-action-focused-support

Budget 2024 must send a message to the rakyat and to foreign investors on how Malaysia is strengthening its economy and the ringgit.

reported by The Star dated 7 Sep 2023

reported by Gutzy Asia dated 21 Aug 2023

The Monetary Authority of Singapore (MAS) announced on 28 July this year that all corporate cheques will be eliminated by end-2025 while individuals will still be able to use cheques for a period after 2025.

This move will affect the Malaysian business community as Malaysian business owners are used to issuing cheques, especially small businesses, said Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM) treasurer Datuk Koong Lin Loong.

He emphasised that hybrid payment methods should be maintained, both e-transfer and cheque payment.